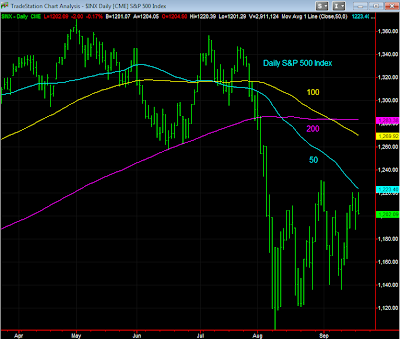

A good consumer sentiment report this morning probably helped keep the market above S1 during the morning session. However, bear market sentiment only allowed the futures to travel half way to the Pivot line and then fall for the rest of the day. Currently, the market is refusing to close above the 10-day moving average. The S&P 500 index is testing the 1120 area again.

Charles