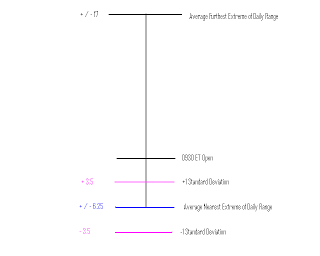

Today's session produced a Narrow Range 4 and 7 day (NR4 & NR7) as the market bounced between the Upper Standard Deviation and Lower Standard Deviation of the Nearest Extreme of the Daily Range. The market found support just above 1360, which is also the upper boundary of a support shelf developed over the last 9 trading days. Weak buying interest prevented the market from trading higher than the Standard Deviation resistance.

MARCH OUTLOOK

The third Friday of March is Good Friday, which means that the ES Contract will expire on Thursday, 03/20/08 - Quadruple Witching Day. Contract rollover will occur on Thursday 03/14/08.

The market tends to be bullish the first half of March, and finish weak following expiration. The next FOMC meeting is on Tuesday, 03/18/08, with the announcement at 1415 ET. The market may be anticipating another rate cut, which is currently being priced into the market. However, the recent market enthusiasm maybe short lived.

Charles