Saturday, February 28, 2009

Friday, February 27, 2009

PreMarket 02/27/09

Thursday, February 26, 2009

Morning Review 02/26/09

In the first 5 minutes, the $TICK reached the 800 level, thus confirming a bullish sentiment at the open. In the correction that followed, the market could not reached the close of yesterday nor the pivot of 764.75. We have been experiencing higher highs and lows up to 1100 ET. Just after 1030 ET, we got a "V" reversal on a small correction. Apparently, shorts had learned their lesson on the previous two corrections. However, the Europeans on their close are taking long position profits, and the markets are back to the open price and slightly below as of this writing.

Charles

Wednesday, February 25, 2009

Tuesday, February 24, 2009

End of Day 02/24/09

This afternoon was the opposite of yesterday with a series of higher highs and lows. The market apparently like a little what Bernanke had to say. He talks again tomorrow.

Some of you may like the series of Squawk Tutorials by TradersAudio. I'm not currently using them, but I have use them in the past. It does help to stay focused on the market, but it is monotonous most of the time.

Charles

Morning Review 02/24/09

Following a strong trend day as yesterday, we should expect a more narrow range day with perhaps a 50% correction of the previous day's range. We should also expect a test of the previous day's high or low, whichever is closer.

Today the market corrected around 40% of yesterday's day session range. The market did not go as close to yesterday's low as I thought that it would, but it did trade down close to the low, and thus far is staying above that low. I suspect most of the up trends are short traders taking profits.

Charles

Monday, February 23, 2009

Morning Review 02/23/09

Sunday, February 22, 2009

Early Bird Doesn't Always Get the Worm

One of my greatest weaknesses in trading is greed. I want all of a trend rather than just being happy with a small piece of it. Unfortunately, this is also the source of most of my losses. I'm slowly learning to be patient and accept the higher probability trade of getting just a piece of a short-term trend.

One good filter to use is the 9 consecutive lows above or at a high pivot, or the 9 consecutive highs below or at a low pivot, which was first proposed by Joseph Hart. The above example is on the opening moves on Friday. We got a uptrend confirmation just before the opening bell, and the market stayed in an uptrend until it retraced 50% of the distance between Thursday close and Friday's open. Long positions were the high probability trade.

If you had used this filter Friday afternoon, you would have avoided a big loss in the quick upsurge after 1415 ET. After 1350 ET, no downtrend mode was confirmed, and the market was in an uptrend mode.

A short-term downtrend was confirmed after 1250 ET. As you can see, after the confirmation, there was still profits to be made with a short position.

I remember seeing a National Geographic show on some birds that nested in small caves (bird size caves) on the side of a hill. One chick broke out of its egg a few days before a sibling, and thus was faster and stronger. The younger, slower chick was slowly starving, because its older sibling was eating all the food that the parents were bringing to the nest.

One day, the older chick saw movement at the cave's entrance, and thought that it was the parents bringing more food. It rushed to the entrance only to be eaten by a snake. The younger, slower and weaker chick stayed quiet in the back of the cave. The snake did not see the younger chick, and moved on to another nest. The younger chick now had no competition for food, and grow to adulthood to pass on its genetic code to another generation.

In trading, it is many times better to be the slower chick.

Charles

One good filter to use is the 9 consecutive lows above or at a high pivot, or the 9 consecutive highs below or at a low pivot, which was first proposed by Joseph Hart. The above example is on the opening moves on Friday. We got a uptrend confirmation just before the opening bell, and the market stayed in an uptrend until it retraced 50% of the distance between Thursday close and Friday's open. Long positions were the high probability trade.

If you had used this filter Friday afternoon, you would have avoided a big loss in the quick upsurge after 1415 ET. After 1350 ET, no downtrend mode was confirmed, and the market was in an uptrend mode.

A short-term downtrend was confirmed after 1250 ET. As you can see, after the confirmation, there was still profits to be made with a short position.

I remember seeing a National Geographic show on some birds that nested in small caves (bird size caves) on the side of a hill. One chick broke out of its egg a few days before a sibling, and thus was faster and stronger. The younger, slower chick was slowly starving, because its older sibling was eating all the food that the parents were bringing to the nest.

One day, the older chick saw movement at the cave's entrance, and thought that it was the parents bringing more food. It rushed to the entrance only to be eaten by a snake. The younger, slower and weaker chick stayed quiet in the back of the cave. The snake did not see the younger chick, and moved on to another nest. The younger chick now had no competition for food, and grow to adulthood to pass on its genetic code to another generation.

In trading, it is many times better to be the slower chick.

Charles

Friday, February 20, 2009

End of Day 02/20/09

Some guy on CNBC was wondering if this was a capitulation day. Not even close. I saw no panic to the downside, but instead, the market just meandered down calmly. I did see panic to the upside as short sellers liquidated as the White House hinted that it wants banks to remain in private hands - maybe.

Charles

P.S. On the 5 minute chart, I wrote that an investor bought BA preferred. I'm referring to Bank of America, which has a ticker symbol "BAC".

Morning Review 02/20/09

Typically, when there is a large gap opening, the market will close at least 50% of that gap. And then, if the European market had a strong bearish sentiment in their morning trading, and lacking any news to change that sentiment, they will probably have a bearish sentiment going into their close. And that is exactly what happened today.

Charles

0.25% Tax on Stocks, Options and Futures Transactions

H.R. 1068 is an amendment being proposed in Congress to add a 0.25% tax on all stock, options and futures transactions. This tax may eliminate me as a trader, or force me to increase my holding time, which would also increase my risks. If you are against this tax, this site has a petition that you can sign, and also a nice form letter that can be used to vote NO for this amendment.

Contacting your Congressperson

Contacting your Senator

Charles

Contacting your Congressperson

Contacting your Senator

Charles

Thursday, February 19, 2009

Morning Review 02/19/09

Europeans trade the market up overnight, and the American trade it down during the day. We got resistance just above 796 as expected, but the market has not made new lows as yet. We are still quite a bit above the November low around 740. Kinda wish that the market would just get it over with and go down and test that low.

Charles

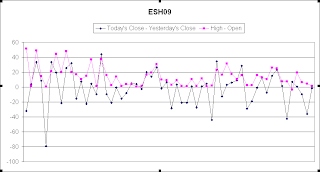

Statistical Analysis of the Market

Food for Thought -

I was once told by a "Market Wizard" that it is statistically significant when the market does the opposite of statistical expectations.

Charles

I was once told by a "Market Wizard" that it is statistically significant when the market does the opposite of statistical expectations.

Charles

Wednesday, February 18, 2009

PreMarket Review 02/18/09

Tuesday, February 17, 2009

PreMarket Review 02/17/09

Monday, February 16, 2009

Various Insights Into Becoming Expert at Anything

Mark Bahti, author of "A Guide to Navajo Sandpaintings"

"My father saw my interest, and thus began my formal instruction in traditional sandpainting under his patient tutelage. At first my tasks were menial: grinding the rocks of various colors, keeping the workshop clean, and preparing the boards for the paintings he did. Like most apprentices, I found the work tedious, but I quickly learned that they are a very necessary part of the whole procedure and would result in a beautiful creation. All forms of art demand discipline if pride in good craftsmanship is to be developed, and sandpainting is no exception."

"Of course, physical labor was only one element in my instructions. I would carefully listen to my father's spiritual instruction, which was the most essential element. He instilled in me the feelings of reverence, pride, and beauty in the traditional sandpaintings. I worked under his guidance for twelve years. As I became older, I sought out others, particularly artists who were willing to share their ideas and knowledge in order to enrich my training. "

Malcolm Gladwell, author of "Outliers" describing how the hundreds of hours performing in Hamburg helped create the Beatles:

"Here is John Lennon, in an interview after the Beatles disbanded, talking about the band's performances at a Hamburg strip club called the Indra:

"My father saw my interest, and thus began my formal instruction in traditional sandpainting under his patient tutelage. At first my tasks were menial: grinding the rocks of various colors, keeping the workshop clean, and preparing the boards for the paintings he did. Like most apprentices, I found the work tedious, but I quickly learned that they are a very necessary part of the whole procedure and would result in a beautiful creation. All forms of art demand discipline if pride in good craftsmanship is to be developed, and sandpainting is no exception."

"Of course, physical labor was only one element in my instructions. I would carefully listen to my father's spiritual instruction, which was the most essential element. He instilled in me the feelings of reverence, pride, and beauty in the traditional sandpaintings. I worked under his guidance for twelve years. As I became older, I sought out others, particularly artists who were willing to share their ideas and knowledge in order to enrich my training. "

Malcolm Gladwell, author of "Outliers" describing how the hundreds of hours performing in Hamburg helped create the Beatles:

"Here is John Lennon, in an interview after the Beatles disbanded, talking about the band's performances at a Hamburg strip club called the Indra:

We got better and got more confidence. We couldn't help it with all the experience playing all night long. It was handy them being foreign. We had to try even harder, put our heart and soul into it, to get ourselves over.

In Liverpool, we'd only ever done one-hour sessions, and we just used to do our best numbers, the same ones, at every one. In Hamburg, we had to play for eight hours, so we really had to find a new way of playing."

"The Beatles ended up traveling to Hamburg five times between 1960 and the end of 1962. ... All told, they performed for 270 nights (five hours or more per night) in just over a year and a half. By the time they had their first burst of success in 1964, in fact, they had performed live an estimated twelve hundred times. ... Most bands today don't perform twelve hundred times in their entire careers."

"They were no good onstage when they went there and they were very good when thy came back. They learned not only stamina. They had to learn an enormous amount of numbers - cover versions of everything you can think of, not just rock and roll, a bit of jazz too. They weren't disciplined onstage at all before that. But when they came back, they sounded like no one else. It was the making of them."

Josh Waitzkin, author of "The Art of Learning" and child chess prodigy (Searching for Bobby Fischer):

“I mentioned that Bruce (teacher/mentor) and I studied the endgame while other young players focused on the opening. … Bruce began our study with a barren chessboard. We took on positions of reduced complexity and clear principles. Our first focus was king and pawn against king – just three pieces on the table. Over time, I gained an excellent intuitive feel for the power of the king and the subtlety of the pawn. … Layer by layer we built up my knowledge and my understanding of how to transform axioms into fuel for creative insight. Then we turned to rook endings, bishop endings, knight endings, spending hundreds of hours as I turned seven and eight years old, exploring the operating principles behind positions that I might never see again. This method of study gave me a feeling for the beautiful subtleties of each chess piece, because in relatively clear-cut positions I could focus on what was essential. I was also gradually internalizing a marvelous methodology of learning – the play between knowledge, intuition, and creativity. From both educational and technical perspectives, I learned from the foundation up.”

“While the weaker player might say, “I just had a feeling,” the stronger player would shrug and explain the principles behind the inspired move. This is why Grandmasters can play speed chess games that weaker masters wouldn’t understand in hundreds of hours of study: they have internalized such esoteric patterns and principles that breathtakingly precise decisions are made intuitively.”

“While the weaker player might say, “I just had a feeling,” the stronger player would shrug and explain the principles behind the inspired move. This is why Grandmasters can play speed chess games that weaker masters wouldn’t understand in hundreds of hours of study: they have internalized such esoteric patterns and principles that breathtakingly precise decisions are made intuitively.”

Charles

Saturday, February 14, 2009

Special Indicators 02/14/09

Subscribe to:

Posts (Atom)