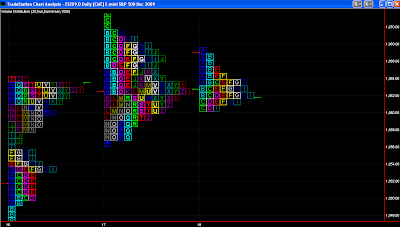

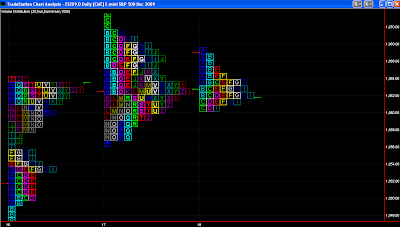

So far we have an inside trading day with the market hanging around near yesterday's Point-of-Control. Actually, I hope that it stays an inside day, since a breakout of today's range next week might be a significant trading opportunity.

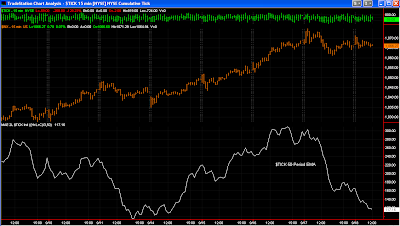

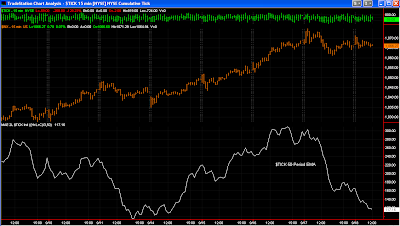

Yesterday we saw the $TICK starting a downward trend. Couple this with the fact that the week following September's Triple or Quadruple witching day is a down week, and you could anticipate that selling would enter today's market.

The market did start out to the downside, but did not go too far. The VWAP Line is currently providing support. So as it turned out, a shorting strategy at the open which was near the overnight high was a successful strategy.

Charles