Life Coach Stuart Schneiderman wrote an excellent blog about repeating mistakes titled "

When You Keep Making the Same Mistake."

In a reference article, "

A Creature of Bad Habit: Why Mistakes Are Repeated ", it is mentioned that thinking about the mistake may actually increase the probability that the mistake will be repeated. If you tell someone to not think about a white bear, that person will start thinking about a white bear. Not only will the person think about a white bear, but the image of a white bear will dwell in that person's mind for a long time.

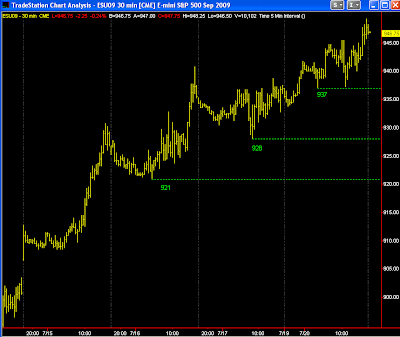

I have noticed this about myself, not only in trading, but in other aspects of everyday life. Sometimes when I see a pothole approaching while driving, I know that I should avoid that hole, but I drive into it anyway. Instead of avoiding the hole, I focus on it, and hit it. When trading, I focus on a bad trade, and end up making the same bad trade again.

Rather than focusing on "If A and B occur, I should NOT do D", we should focus on, "If A and B occur, I SHOULD do C".

This has made me rethink other life situations. For example, minority groups trying to eliminate discrimination against their group. Too often, they use the tactic of convincing society that discrimination against their group is bad. From a psychological viewpoint, they may actually be promoting discrimination rather than eliminating it. What they really should be doing is telling society that their group is beneficial to society because ....

Charles