Saturday, February 27, 2010

ES Futures End of Day Reveiw 02/26/10

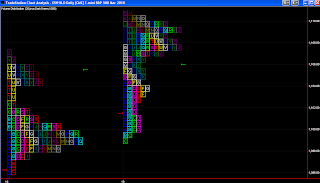

The market never could trade above the overnight high of 1107.75. In the end, the market settled at its daily average of 1102.75, which is also the day's Point of Control. We have a larger volume area between 1102 and 1105.

Charles

Friday, February 26, 2010

ES Futures Morning Review 02/26/10

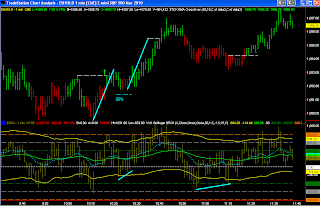

Another V reversal at 1096.25. The only thing significant about that number is that it was 50% of the range between yesterday's low and this morning's high. Looks like who ever is buying the market needed to finish before the end of the month, and did most of their buying before lunch today. Anyway, the market found resistance 2 handles below the overnight high, and is now hovering near the VWAP line.

Charles

ES Futures Premarket Review 02/26/10

The overnight market is staying close to yesterday's futures close of 1102.25, and above the lower end of Wednesday's high volume area. The overnight range so far is between 1107.75 and 1100.75.

We have three economic reports coming out between 0945 and 1000 ET. These may oscillate the market.

Right now we are 12 points or handles above yesterday's average price of 1092, and about 14 handles above the upper end of yesterday's high volume area. Currently, we are a lot closer to short-term resistance levels than support levels. The market will need a reason to trade through resistance.

Charles

Thursday, February 25, 2010

ES Futures End of Day Review 02/25/10

Today's Point of Control is 1088.50 with a larger volume support area between 1086 to 1090.

We will have to wait and see if the Europeans sell the EURO again tomorrow morning because of concerns with Greece. So far the American market keeps buying these dips.

Charles

ES Futures Upside Break 02/25/10

This is always easy to see after the fact, but sometimes difficult to see as it is happening. This is one of the reasons why I publish these charts - to help me visualize these patterns.

After 1300 ET, the market looked like it was going to form a downward correction pattern. We got a lower pivot low with the usual upside correction that was lower than the previous pivot high; however, the $TICK made a higher pivot high which was a caution flag for short sellers. Then the market made a higher pivot low rather than a lower one. This higher pivot low was validated by a higher pivot high. Soon after, the market broke to the upside vigorously.

Charles

ES Futures Morning Review 02/25/10

The $TICK did not hit -800 until after 1120 ET. So the market is staying above the opening low. Someone out there is still buying on dips.

Charles

ES Futures Premarket Review 02/25/10

The dollar is strengthening against the EURO and Greek bonds are down graded. And, the chart above looks like a Head and Shoulders formation. The neckline is resistance.

Charles

Wednesday, February 24, 2010

ES Futures End of Day Review 02/24/10

The market managed to close above its Point of Control which is 1103.50 - 1103.75. We also have a strong volume area between 1100 and 1104.

The points where you can have the highest profit potential is on test of recognized support and resistance levels. The support level today was yesterday's Point of Control, and the resistance level was bottom of the equilibrium zone between 1105 and 1111. The market corrected after testing that 1105 level. When 1105 was tested, the NYSE Advance - Decline Line did not make a higher high. However, the A - D Line doesn't always lead the futures market. After 1430 ET, the A - D Line made a lower low, but the futures made a higher low. The market then traded up from that point.

Charles

ES Futures Morning Review 02/24/10

After 1000 ET, we again got the selloff that tested yesterday's high volume area. That area held as support, and the market took off to the upside.

The two things to look for in a reversal is either a divergence of some type ($TICK, Advance - Decline Line, Volume, etc.), or the market making a higher or lower low or high. This time the market made a higher low with $TICK confirmation, and the market rocketed to the upside. With this occuring near the Point of Control gave it credibility.

Charles

ES Futures Premarket Review 02/24/10

The market overnight sold off a little, but remained above yesterday's low. The overnight range thus far is 1099.50 to 1092.50, with the market now above yesterday's Point of Control now support.

Here is a Dutch video titled " Quants: The Alchemists of Wall Street. " The introduction and short narratives are in Dutch, but the program itself is in English.

Charles

Tuesday, February 23, 2010

ES Futures End of Day Review 02/23/10

Today's Point of Control is 1095, which the market closed above. A larger volume support area spans from 1092.75 to 1096.

As the Futures was continuously trying to make lower lows, the NYSE Advance - Decline Line was staying above its morning low. Also the $TICK 50-period moving average on the 1-minute chart was hovering near zero. This indicated buying activity. The "b" formation of the Market Profile Chart confirms that activity.

Charles

ES Futures Morning Review 02/23/10

The market is trying to find support at the 10-Period EMA on the daily chart. This is after testing the 1107 area, and then continuing the weakness of the overnight market catalyzed by dissapointing economic reports this morning. Bernanke talks tomorrow.

Charles

ES Futures Premarket Review 02/23/10

The market is trading down from the upper boundary of the daily trading channel. The market may revisit yesterday's average price and Point of Control, both of which are near 1107. 1107 is now resistance.

Charles

Monday, February 22, 2010

ES Futures End of Day Review 02/22/10

The market's refusal to make a lower low just before lunch led to a step-wise uptrend in the afternoon. Got some profit takin going into the close, but the futures closed above its Point of Control at 1107. So the market ended close to where it ended on Friday.

Charles

ES Futures Morning Review 02/22/10

The market reacted to $TICK divergences well this morning, keeping the market in a relatively narrow range. Traders can be creators of habit. Friday morning the market reversed at 1007 ET, and this morning it reversed at 1010 ET.

Charles

Saturday, February 20, 2010

Sleep - Your Brain - Meditation

Following are a collection of articles and videos that may give you an insight into how your brain and mind really work, how to improve learning a new skill, how to reduce fear / anxiety and increase compassion and confidence, and how to improve your general health - which may have more to do with your mental state than you realize.

In the article " Sleep, Tetris, Memory and the Brain ", Dr. Shannon Mofett discusses research by Dr. Robert Stickgold which shows how sleeping or taking a nap just after learning a new skill improves your ability to remember and perform that skill in the future.

Here is a collection of short videos called " Why Sleep Matters " by Harvard researchers on the effects of sleep on memory and health.

In the article " Exercise and Mediterranean-type Diet Combined Appear to be Associated with Lower Risk for Alzheimer's Diseae ", Dr. Nikos Scarmeas discusses how the combined life-style of regular exercise and a Mediterranean Diet can reduce your chance of developing Alzheimer's Diseae by 60%. In another report " Mediterranean Diet May Help Keep You Smarter ", it is suggested that a Mediterranean Diet may protect aging brains from damage linked to cognitive problems.

Dr. John Medina in this YouTube video discusses his Brain Rules, which include Exercise, How the brain evolved, How every brain is wired differently, Our Attention, Short-term and Long-term memory, Sleep, Stress, Vision and how Male and Female brains are different.

A Youtube video called " Change Your Mind, Change Your Brain: The Inner Conditions for Authentic Happiness " by Matthieu Ricard. An interesting presentation that shows how meditation can phycially change your brain to improve attention span, reduce anxiety ' fear, increase compassion and confindence and improve your health and keep you young. Research data is discussed in the last half of the video.

Enjoy!

Charles

In the article " Sleep, Tetris, Memory and the Brain ", Dr. Shannon Mofett discusses research by Dr. Robert Stickgold which shows how sleeping or taking a nap just after learning a new skill improves your ability to remember and perform that skill in the future.

Here is a collection of short videos called " Why Sleep Matters " by Harvard researchers on the effects of sleep on memory and health.

In the article " Exercise and Mediterranean-type Diet Combined Appear to be Associated with Lower Risk for Alzheimer's Diseae ", Dr. Nikos Scarmeas discusses how the combined life-style of regular exercise and a Mediterranean Diet can reduce your chance of developing Alzheimer's Diseae by 60%. In another report " Mediterranean Diet May Help Keep You Smarter ", it is suggested that a Mediterranean Diet may protect aging brains from damage linked to cognitive problems.

Dr. John Medina in this YouTube video discusses his Brain Rules, which include Exercise, How the brain evolved, How every brain is wired differently, Our Attention, Short-term and Long-term memory, Sleep, Stress, Vision and how Male and Female brains are different.

A Youtube video called " Change Your Mind, Change Your Brain: The Inner Conditions for Authentic Happiness " by Matthieu Ricard. An interesting presentation that shows how meditation can phycially change your brain to improve attention span, reduce anxiety ' fear, increase compassion and confindence and improve your health and keep you young. Research data is discussed in the last half of the video.

Enjoy!

Charles

Friday, February 19, 2010

ES Futures End of Day Review 02/19/10

We have a volume resistance area between 1108.50 and 1107.50, which the market closed just below.

In the afternoon, we got a 3-wave correction followed by another correction before the market bounced to the upside. The first correction is usually the high probability trade.

Charles

ES Futures Morning Review 02/19/10

Buyers waited until the market tested yesterday's Point of Control, at which the market started its uptrend. Since the NYSE Advance - Decline Line was indicating relative weakness, I was surprised when the market traded past yesterday's close and high - especially going into the European close for the weekend.

Charles

ES Futures Premarket Review 02/19/10

The overnight market found support at the 1092.50 level, and after the release of the CPI number, it is again over the 1100 level and over yesterday's Point of Control near 1099.50. So the market is back above key support levels.

Charles

Thursday, February 18, 2010

ES Futures End of Day Review 02/18/10

The market stayed above yesterday's Point of Control most of the day. Today's Point of Control is near 1099.50.

After the morning correction to the 0930 ET open, the NYSE Advance - Decline Line kept indicating a slightly more bullish sentiment than the Futures. Eventually, the futures popped above the 1100 resistance line. The market did this with less than enthusiastic volume. Also, as I am writing this post, the market is trading down to 1097 rather rapidly. So, today's bullish sentiment may not carry into tomorrow.

Charles

Morning Review 02/18/10

A breakout of the range of a NR7 day is suppose to be a high probability trade. However, the NYSE Advance - Decline Line did not indicate an extremely bullish market. The AD Line was at the lowest of the last several days. Also, as the ES Futures made a new high, the dollar was strengthening against the EURO, which is typically negative for the stock market. The market actually did retreat from its high.

This may be a short-term topping process.

Charles

ES Futures Premarket Review 02/18/10

An incease in pricing pressure combined with a lack of new job growth is giving the market to sell away from the 1100 resistance. Yesterday's Point of Control at 1097.25 is also resistance. The market is currently making new lows for the day.

Charles

Wednesday, February 17, 2010

ES Futures End of Day Review 02/17/10

Today's Point of Control is 1097.25, and the market closed above this point. We are still below the 1100 level. Today is also a Narrow Range 4 and 7 day. Let's see what the overnight market gives us.

Charles

ES Futures Morning Review 02/17/10

1100 continues to act as resistance. Currently, the market has found support at the overnight low.

Charles

ES Futures Premarket Review 02/17/10

The overnight market has topped at exactly 1100. It found support at 1092.50. The market will probably need a good reason to trade much above 1100.

Charles

Tuesday, February 16, 2010

ES Futures End of Day Review 02/16/10

The afternoon session was uneventful until the last thirty minutes. The market is 6 points from 1100, which is considered resistance. Today's Point of Control is 1088.

Charles

ES Futures Morning Review 02/16/10

1079.50 held as support. After the double bottom formation, we couldn't quite get a 50% correction, but did achieve a bullish 3-wave symmetrical pattern. After that, the third wave of the next correction was shallow and had a bullish $TICK divergence signal going into the European close. The market is now making new highs for the day.

Charles

ES Futures Premarket Review 02/16/10

The 1079.75 price level is holding as support, with the market well above Friday's Point of Control at 1073. So the bullish momentum of late Friday continues.

Charles

Saturday, February 13, 2010

ES Futures End of Day Review 02/12/10

Following a roller coaster afternoon, the market closed well above its Point of Control at 1073. Each time the futures corrected down, the NYSE Advance - Decline Line corrected to a lesser extent. The futures then bounced back up with the $TICK swinging from +1000 to -1000. At the afternoon lows, we got well defined bullish divergences.

Overall - the bulls won the battle.

Charles

Friday, February 12, 2010

ES Futures - Morning Review 02/12/10

This is similar to what happened yesterday after 1100 ET. The $TICK goes down to - 600, but the Futures is making a higher low. Also, the NYSE Advance - Decline Line is not correcting to the downside as much as the Futures is correcting. Then we get a little bump to the upside.

All in all, the market is bearish, but not extremely bearish.

Charles

ES Futures Premarket Review 02/12/10

The market is giving back yesterday's gains following the Chinese central bank increasing reserve requirements by 50 basis points. I suspect long term investors may also be concerned that other centrol banks may be considering similar moves in the future.

The market is still bouncing off its 10-period EMA on the daily chart to the bear side of the channel.

Charles

Thursday, February 11, 2010

ES Futures End of Day Review 02/11/10

The market closed just above the Point of Control at 1076. The afternoon session gave us a sideways market with the market bouncing off the -600 $TICK corrections.

Charles

ES Futures Morning Review 02/11/10

The market has run out of sellers, and it was eventually able to trade above yesterday's Point of Control.

After 1000 ET, - 600 $TICK became support on corrective moves.

Charles

Subscribe to:

Posts (Atom)