Saturday, August 30, 2008

Friday, August 29, 2008

Thursday, August 28, 2008

The Fade - 08/28/08

Wednesday, August 27, 2008

Morning Review - 08/27/08

Key Pivot Points

If the market reverses, it is typically near some key pivot point, such as the previous day's high or low, the 0930 ET open or the morning's high or low. There are many more, but these are the major ones. If there is to be a big move in the market, it is usually after a test of a key pivot point.

Tuesday, August 26, 2008

Morning Review - 08/26/08

German Economic Woes and the Dollar

The Dollar is strengthening against the Euro due to concerns about possible trouble with the German economy. Crude and Natural Gas prices are currently more concerned about the dollar than Gustav.

Monday, August 25, 2008

Morning Review - 08/25/08

The fast moving average on the 620 tick chart has been red all morning, along with the fast moving average of the 5 minute $TICK.

Saturday, August 23, 2008

Weekend Thoughts - 08/23/08

In the interview, Suri has a nice discussion about the Trader Vic 2B and ABC or three-wave patterns. The ABC pattern is probably the one that I pay attention to the most, but should also pay more attention to the 2B type of setup, which is similar to the 1039 ET $TICK / Price divergence that we saw yesterday.

The first 30 minutes of open market activity can be an extremely profitable or unprofitable time of day to trade. It has not been my best time of the day to trade. It is a time of day when proper money management is truly important, since the market has a tendency from time to time to turn on a dime during this emotional and volatile period.

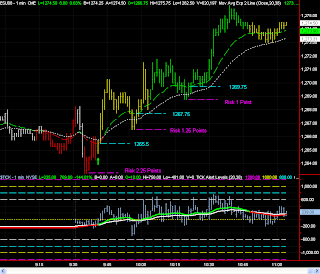

Yesterday, the market was bullish during this period due to Lehman news and the upcoming Bernanke speech. As the market bounced off the 38 Period EMA on the 630 tick chart, a good trade setup would have been an entry at 1284.5 with a stop at 1282.75, which was a risk of less than 2 points. The potential reward was close to 10 points, which could have been based on the up surge from 1277 to 1288 with a 50% correction to 1282.75. An example of assessing potential reward to risk.

Even though you should not rely much on the $TICK in the first 15 to 30 minutes, it did confirm the bullish attitude of the market in the first 30 minutes to help develop confidence in the trade.

In the case of yesterday morning's Price / $TICK divergence trade, you are not sure what the potential reward might be. The risk is the high. What can be done here is to trade in multiples of three contracts. Phase out 2 contracts as the market goes in your direction for two points, and keep the third contract for possible large moves with a breakeven stop for the third contract.

Charles

Friday, August 22, 2008

Afternoon Review - 08/22/08

Morning Review - 08/22/08

1030 ET - $TICK starting to weaken a little. An hour a way from the European close. Will have to wait and see when short-term equity traders start taking profits.

1100 ET - Large divergence occurred between price and $TICK at 1039 ET. Market may be topping out.1120 ET - Getting a nice correction following the divergence. Entering the lunchtime period and the European close.

Charles

Thursday, August 21, 2008

ESU08 Range and High/Low Analysis

In the above chart, the True Range is based on the 0930 - 1600 ET time period. As can be seen, the daily True Range is seldom below the 10 day average for more than three days. Tomorrow's range may be larger than the average.

Afternoon Review - 08/21/08

1515 ET - Well, the short-term up cycle won over the bad news bears, at least for today.

Charles

Morning Review - 08/21/08

1137 ET - We are still in a narrow range. Even though the market is not moving very much, the tendency is more toward the upside than downside, since we are still in the upside part of the short-term cycle.

Charles

Early Morning Reading - 08/21/08

Should we rescue Freddie Mac and Fannie Mae?

What is a GSE anyway?

Charles

PreMarket Review - 08/21/08

Wednesday, August 20, 2008

Afternoon Review - 08/20/08

1400 ET - Indicators started looking positive around 1315 ET, however, market is just below the 0930 ET open, which by many is a resistance point. Not looking for a break above this point, since the market feels weak. Also, the market usually does not show its true intention until after 1400 ET as the energy and bond markets start to wind down.

1430 ET - Good down trend into the energy market close. Psychologically, it is the most difficult for me to enter a trade when the momentum first change from postivie to negative or vice versa, but that point is also when the most profit can be made.

1500 ET -After the energy market close, momentum change back to positive, as the market failed to make a new low. Today has been an interesting tug-of-war between the bears and bulls. The 0930 ET open is still providing resistance.

1600 ET - Nice strong finish at the close, and finally broke the 1271 barrier this afternoon. Crude may go to $150, but not today.

Charles

Morning Review - 08/20/08

1010 ET - The sell-the-dollar, buy energy and sell equities crowd is back, probably due to the Goldman Sachs Report this morning. Will wait and see how the market reacts to the 1035 ET crude report.

1143 ET - The crude report showed a larger increase in crude inventory than was anticipated. The report gave us a nice uptrend in equities, which should have happened in the first place. However, it is not uncommon for the market to retest the lows before reversing trend.

Charles

PreMarket ESU08 Review - 08/20/08

We indeed got a more narrow range day yesterday as expected. However, the trading range of the day occurred below the previous day's low rather than above it due primarily to the PPI report, which did not include the recent down turn in commodity prices. It was a day, though, where swing traders typcially liquidate short trades and start to initiate long trades.

In the above chart, you can see that the (High - Open) difference has been below 10 points for three days, which usually sees a reversal in the short-term trend. Overnight, the market has indeed traded to the upside.

Tuesday, August 19, 2008

Following "S" Days

Yesterday was an "S" day with a large range. The next day typcially has a more narrow range.

7/24/08 is a day with a similar chart pattern as yesterday, and was also an "S" day. The following day was a narrow range day, which tested the previous day's low several times.

Mid-day 8/12/08 to mid-day 8/13/08 also has a similar chart pattern as yesterday. The following period had a bigger range than 7/25/08, but the market still tested the previous low at least once.

Late 7/31/08 had a sell off period, again followed by a narrow range period, which tested the previous low several times.

Oil is currently dropping in price as Fay becomes less of a concern.

Charles