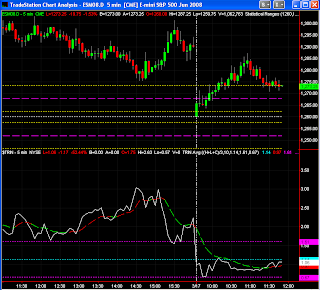

This morning's session was a good time to be a contrarian. The market was able to correct 50% of the overnight down trending trading range. We will get a good sense of what the afternoon sentiment is after 1300 ET.

The first thing that was noticable this morning was that the $TRIN was much more bullish today than it was during Friday's session. It showed bullishness while the other indicators were still bearish, which is an important divergence to notice.

Both the $TICK and NYSE Advance - Decline Line did not indicate bullishness until around 1000 ET, but stayed rather bullish until the 50% correction was achieved.

This Thursday, 03/20/08, is quadruple witching, and the markets are closed Friday. The market is expecting another rate cut tomorrow from the Federal Reserve.

Charles

No comments:

Post a Comment